Blue Crane Capital on LinkedIn New deal arranged by Blue Crane Capital NN• Purpose Mixed Use…

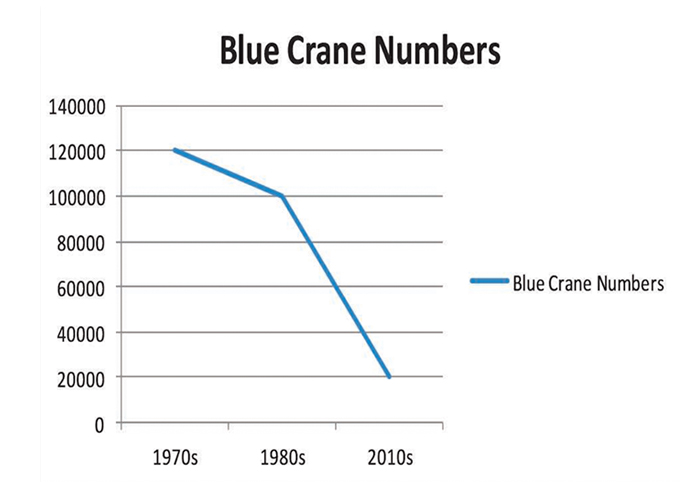

Saving the endangered blue crane do your bit

658 Followers, 1,133 Following, 277 Posts - See Instagram photos and videos from BLUE CRANE CAPITAL (@bluecranecapital)

wq8qYik7RNikb2dsN0y7EkWIO_pwZu_OyNswXjV972T5neuqDyva6Dex_IUwjbDiMwvznlY95g=s900ckc0x00ffffff

Blue Crane Capital's development finance process. Most new clients that approach us wanting to explore financing options (on their project) have never heard of non-bank or the private funding.

Crane Capital

Blue Crane Capital are property finance specialists with the professional capability and experience to navigate our clients through their complex residential, commercial property and construction transactions. Chris Hall MANAGING DIRECTOR & FINANCE BROKER Chris Hall is the Founder and Managing Director of Blue Crane Capital.

Blue Crane Capital on LinkedIn Let us help plan, structure & connect your financing needs to

First Atlantic Capital. Founded in 1989 by Roberto Buaron, First Atlantic Capital is a middle market private equity firm that leverages its extensive consulting and operational experience to acquire middle market companies, seeking to build them up to become market leaders. Since its inception, the firm has completed more than 70 acquisitions.

Capital Blue Cross TheBurg

Blue Crane Management, Leonia, New Jersey. 41 likes. http://www.bluecranemgnt.com

Blue Crane Capital on LinkedIn New deal arranged by Blue Crane Capital NN• Purpose Mixed Use…

Blue Crane Capital Pty Ltd is a credit representative (Credit Representative Number 504789) of BLSSA. Want to speak to someone about your scenario? Call us on +61 400 680 670 . Email us: [email protected]. Request a callback. Name * Phone * Pick your type of commercial property * State.

Andile Ramaphosa Says He Was A “PoliticallyExposed Individual” Daily Worthing

At Blue Crane Capital, with our wider team experience in commercial banking, we understand commercial property finance better than anyone. Whether owner occupied or investment, for purchase and refinance in SMSF, we have been recognised as the industry leaders in arranging SMSF property loans for the past five years.

Contact Blue Crane Capital

Blue Crane Capital is a smart technology business with a focus on providing Advisory services, Project development and Fund development. We excel in sourcing internationally from Asian, American.

Facebook Post For Blue Crane Capital on Behance

Blue Crane Capital Financial Services Sydney, New South Wales 2,615 followers Real Estate Finance Specialists Commercial, Construction, Residential & SMSF Property Finance Follow View all 7.

Blue Crane Capital on LinkedIn home investment owneroccupied homeloan

Associate Director and Finance Broker. Blue Crane Capital. Jan 2020 - Aug 2022 2 years 8 months. Sydney, Australia.

Blue Crane Zoo Atlanta

BLUEPRINT CAPITAL ADVISORS, LLC v. STATE OF NEW JERSEY, DEPARTMENT OF THE TREASURY, DIVISION OF INVESTMENT by TREASURER ELIZABETH MAHER MUOIO et al, No. 2:2020cv07663 - Document 201 (D.N.J. 2022) case opinion from the District of New Jersey US Federal District Court

Rate check Survey

Blue Crane Capital. 2,614 followers. 4mo Edited. We are seeing more partial complete construction deals due to the rain delays and rising construction costs of 2022/23. Clients are engaging us.

Minimal line art creates the shape of a bird in this logo design by artsigma for Blue Crane

Welcome to Blue Crane Capital. We provide high-value finance brokerage solutions for clients looking to transact on commercial property, residential property and construction projects. Our award-winning team continue to set the benchmark for the industry with over $2.5 billion worth of assets transacted since March 2017.

Bluecrane Buildup

Blue Crane Capital (Pty) Ltd Dec 2014 - Present 9 years 2 months South Africa Central Executive, South Africa Macquarie Group Dec 2012 - Nov 2014 2 years Standard Bank Group 3 years 8 months.

Blue Crane Capital Lending Finance Australia

Thorofare Capital has provided a $30.8 million redevelopment loan to The Chetrit Group for 440 Elizabeth Avenue, a 25-story multifamily tower adjacent to Newark International Airport in Newark, N.J., Commercial Observer can first report.. The property, formerly known as Carmel Towers, was built in 1969 and has been vacant since 2012. It t owers over the Weequahic neighborhood in Newark's.

Photos Sneak Peak Inside Capital as Crane Comes Down SkyriseEdmonton

In an interview with MPA, Blue Crane Capital managing director and 2019 MPA Young Guns finalist Chris Hall said they chose clarity because he wants borrowers who are often embarrassed to ask.